A large and fragmented kitchenware market provides opportunity for growth

Our primary market is the UK kitchenware market which is large and fragmented providing ProCook a significant opportunity for growth. Euromonitor1 estimate the market size was £3.4bn in the calendar year 2021, growing by +7.8%. We estimate that our share of this market increased to 2.2% in 2021 (2020: 1.7%).

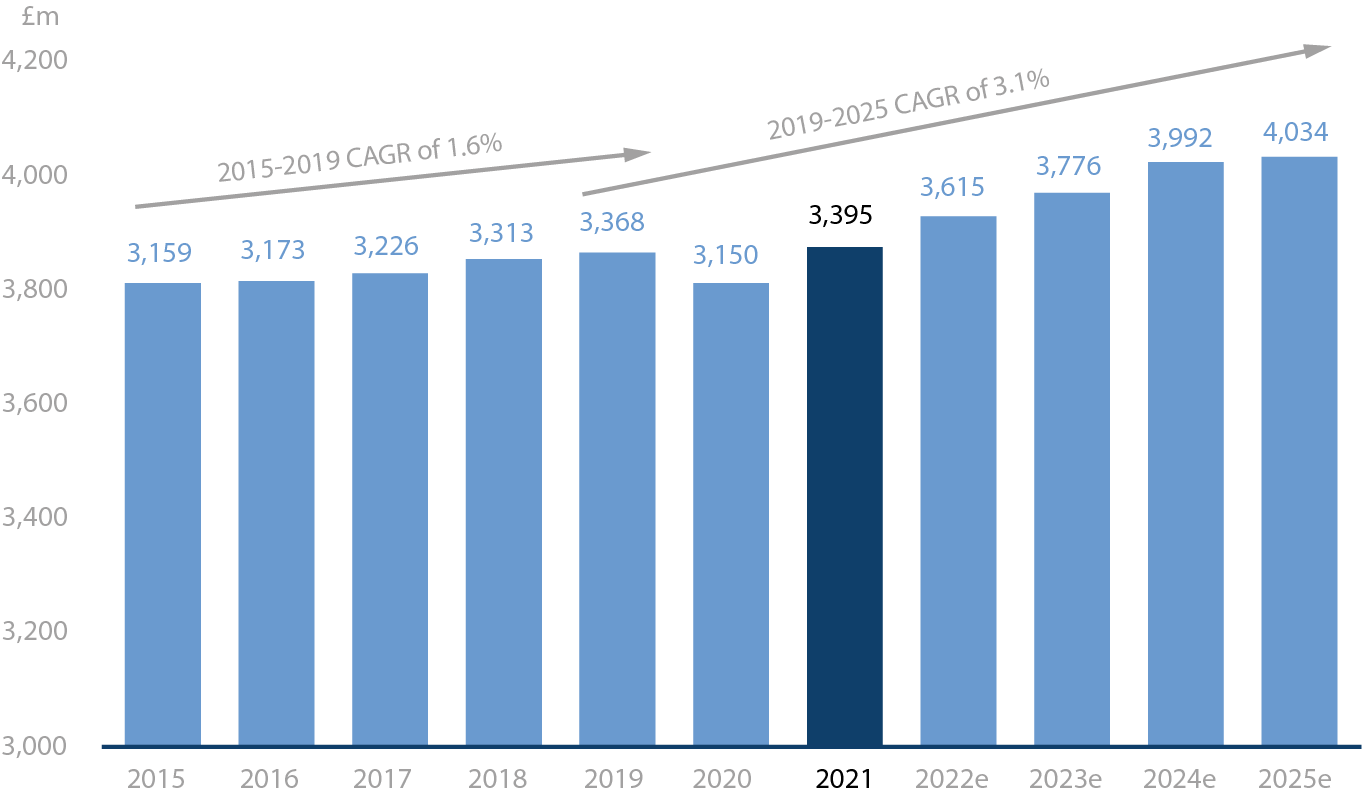

Between 2015 and 2019 (being the last full year prior to the impact of Covid-19), the industry grew steadily at a compound annual growth rate (CAGR) of +1.6% and has historically remained resilient during economic downturns. In 2020, the market contracted by -6.8% driven by the enforced store closures to counter the spread of Covid-19. Whilst ecommerce sales grew significantly, sporadic access to retail, exacerbated by major supply chain issues reduced sales as consumers were unable to access products and brands conveniently and consistently.

Following this decline, growth of +7.8% in 2021 was driven by the full reopening of retail stores from April 2021 onwards, as consumers continued to place increased value on their home environments, spending significantly more time cooking and entertaining at home.

Looking forward, Euromonitor estimates that UK sales of kitchenware in 2025 will grow to £4.0bn, representing a CAGR of +3.1% from 2019 supported by sustained interest in cooking and entertaining at home as consumers on average will spend more time at home compared to pre-pandemic. Stronger growth potential will be restrained by the inflationary macro environment which will drag on consumer’s disposable incomes.

We note that whilst this market size forecast is largely driven by price effects rather than volume in the next two to three calendar years, the heightened uncertainty in the consumer environment mean that such forward-looking expectations should be taken with a degree of caution.

ProCook’s wider market opportunities include small kitchen electricals which we understand has a market size in the UK in excess of £1bn, as well as overseas EU markets including Germany, France and the Netherlands which together had a kitchenware market size of approximately £8bn in 2020.

UK Kitchenware Market (£m)

Macroeconomic landscape

The current UK consumer environment has deteriorated significantly and rapidly over recent months driven by rising inflation, reaching +9.1% in May 2022, causing a cost-of-living squeeze as domestic budgets are impacted by increased energy, fuel and grocery prices, compounded by higher interest rates and taxes.

The two key macro-economic causes are the legacy of Covid-19 disruption in manufacturing and supply chains, and the Russian war on Ukraine.

Consumer confidence has deteriorated to record low points, worse than the 2008 financial crisis and the height of the Covid-19 pandemic. Many economists are predicting this inflationary pressure has not yet peaked, and there is much uncertainty around how long this this will last.

Against this backdrop, consumers are increasingly having to make difficult choices about where to spend and how to cut back. This has already had wide-ranging adverse effects on the Retail sector as a whole.

2.2%

ProCook market share (2021)

£3,395,m

UK kitchenware

market size (2021)

72.8%

Market in-store

sales mix (2021)

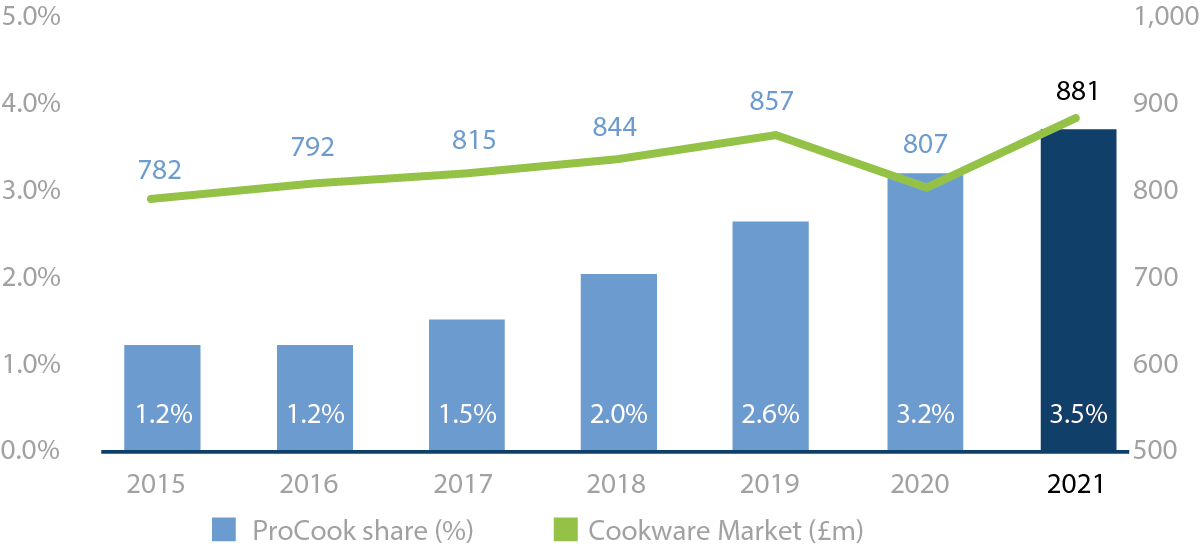

Cookware Market

£881M

Market in 2021

Cookware, comprising stove-top and ovenware products, had a market size of £881m in 2021 and we estimate we grew our share to 3.5% in 2021 (2020: 3.2%). Cookware is ProCook’s heritage category, our range features quality products at good, better, best price points to suit customers’ needs, tastes and cooking preferences.

ProCook share (%) Cookware Market (£m)

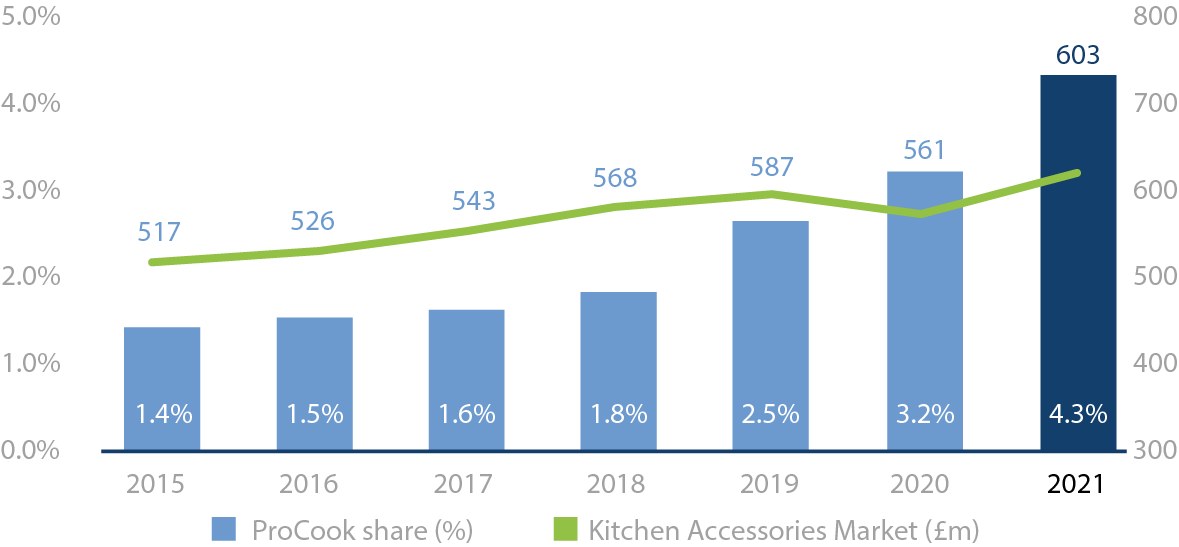

Kitchen Accessories Market

£603M

Market in 2021

Kitchen accessories, comprising kitchen utensils and food storage products, had a market size of £603m in 2021 and we estimate our share increased to 4.3% in 2021 (2020: 3.2%). As a kitchenware specialist our broad range of utensils, knives, and other kitchen accessories provide choice, convenience and great value for customers.

ProCook share (%) Kitchen Accessories Market

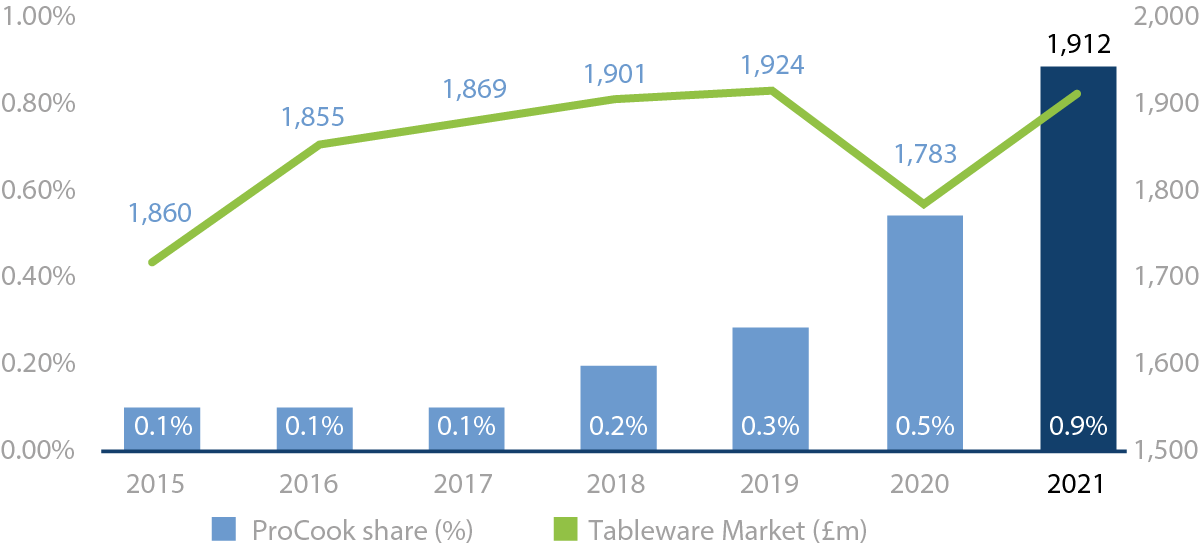

Tableware Market

£1,912M

Market in 2021

This category is ProCook’s newest, and comprises dinnerware, cutlery and beverageware. With a market size of £1.9bn in 2021, this presents a significant opportunity for growth as our share is still small; we estimate that we increased our share to 0.9% in 2021 (2020: 0.5%). We see continued opportunity to expand and develop our ranges and attract more customers to ProCook in this category.

ProCook share (%) Tableware Market

Consumer trends

01

Sustainability

Customers are increasingly aware of a brand’s sustainability credentials and are making more sustainable choices in their own lives. This is likely to become increasingly important for ProCook as brands compete to retain newly acquired millennial consumers, a group whose interest in kitchenware grew during the pandemic.

The durability of our products which are designed to last many years, alongside our focus on reducing our environmental footprint is important for our customers. The progress we have already made is giving us more confidence to be more vocal about our existing credentials in our messaging to customers.

02

Increase in home cooking

The impact of the pandemic has resulted in a substantial and sustained increase in homecooking and home-entertaining as consumers spent more time in their homes, and continue to do so with home-working remaining far more common-place. Publicly available research indicates that 91%2 of consumers expect to continue to cook at home either as much, or more than they did during the pandemic.

The current cost of living pressures are creating significant challenges for consumers. We expect that the trend of eating-in versus out is likely to remain in play at least for the short to medium term as eating-out becomes increasingly expensive.

03

Ecommerce growth

Physical retail still has a significant role to play in kitchenware providing a setting for customers to test, seek advice and take products home the same day. Currently more than 70% of kitchenware sales are still completed in a store environment.

However, ecommerce sales of kitchenware have grown significantly during the last few years, and we expect this trend to continue as younger generations of customers who are typically more at ease purchasing online, form a larger part of the sales mix.